Compliance

Updated Compliance Requirements and Regulations

ALL REQUIRED INFORMATION MUST BE INCLUDED AND ACCURATE

WHEN CREATING OR REVIEWING ANY MORTGAGE-RELATED ADVERTISEMENT, ENSURE THAT THE FOLLOWING LICENSING ELEMENTS ARE INCLUDED AND CORRECT:

.jpg)

.jpg)

.jpg)

.jpg)

LEGAL DISCLAIMER LANGUAGE

WHEN CREATING ANY MORTGAGE-RELATED ADVERTISEMENT, ENSURE THAT THE FOLLOWING DISCLAIMER LANGUAGE IS INCLUDED AND CORRECT:

My Community Mortgage LLC, NMLS #2408499. Phone number: (337) 501-0155. Additional terms and conditions may apply. Information is subject to change without notice. Any financing shown is for comparison or example only. Some products and services may not be available in all states. This is not an offer for extension of credit or a commitment to lend. All loans are subject to credit and underwriting approval. Not all applicants will qualify. This is an advertisement only.

ALL ADVERTISEMENTS IN TEXAS (ONLY) MUST ALSO INCLUDE THE FOLLOWING:

Consumers wishing to file a complaint against a company or a residential mortgage loan originator should complete and send a complaint form to the Texas Department of Savings and Mortgage Lending, 2601 North Lamar, Suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the department’s website at https://www.sml.texas.gov/.

A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s website at https://www.sml.texas.gov/.

EQUAL HOUSING OPPORTUNITY LOGO

EHO logo should be on EVERYTHING advertising MCM.

-

Print Advertisements (flyers, brochures, magazines, newspapers)

-

Online Listings and Digital Ads (Zillow, MLS, social media posts, Google Ads)

-

Websites (especially for real estate companies, property managers, housing authorities)

-

Email Marketing (newsletters, listing alerts)

-

Promotional tems (postcards, signage, banners)

-

Television or Video Ads (can be displayed visually)

-

Business Cards

Example for the Bottom of a Flyer

My Community Mortgage LLC, NMLS #2408499. Phone number: (337) 501-0155. Additional terms and conditions may apply. Information is subject to change without notice. Any financing shown is for comparison or example only. Some products and services may not be available in all states. This is not an offer for extension of credit or a commitment to lend. All loans are subject to credit and underwriting approval. Not all applicants will qualify. This is an advertisement only.

MORTGAGE ADVERTISING LAWS & REGULATIONS

THIS QUICK-REFERENCE GUIDE OUTLINES THE PRIMARY FEDERAL LAWS AND REGULATIONS GOVERNING MORTGAGE ADVERTISING

1) Truth in Lending Act (TILA) - Reg Z:

- Disclose APR when quoting interest rates.

- Trigger terms (e.g., payment, rate) require full disclosures.

- Prohibits misleading terms like "guaranteed approval."

2) Real Estate Settlement Procedures Act (RESPA):

- Bans referral fees or kickbacks for business.

- Co-marketing with realtors/builders must be fair and compliant.

- Requires AfBA disclosure when referring to affiliated entities.

3) Equal Credit Opportunity Act (ECOA):

- Prohibits discrimination in marketing (race, gender, age, etc.)

- Ensure inclusive and fair targeting.

4) Fair Housing Act:

- Requires Equal Housing logo on all ads.

- Avoid discriminatory phrases or images.

5) Fair Credit Reporting Act (FCRA):

- Requires consent to use consumer credit data for marketing.

- Opt-out notice needed for pre-screened offers.

6) UDAAP - Unfair, Deceptive or Abusive Acts or Practices:

- Enforced by CFPB.

- No deceptive claims or omissions.

- Avoid misrepresenting loan terms, approvals, or affiliations.

7) CAN-SPAM Act:

- Applies to email marketing.

- Must include opt-out link and company info.

- No misleading subject lines.

8) Telephone Consumer Protection Act (TCPA):

- Requires express written consent for calls/texts.

- Respect DNC registry and contact restrictions.

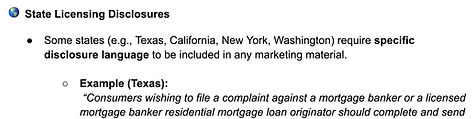

9) State-Specific Laws:

- Include state license numbers and disclosures as required.

- Use exact company/LO names as licensed in that state.

- Reference the state licensing disclosure sheet for details.

REMEMBER:

- Always include NMLS IDs and Equal Housing logo.

When in doubt, submit advertising to Compliance before publishing.

Save copies of all advertising for audit trail.

Contact your Compliance Director with any questions.